- #Email outstanding invoices in quickbooks how to#

- #Email outstanding invoices in quickbooks software#

To reduce unnecessary stress, businesses need to minimize the number of outstanding invoices they deal with. Overdue invoices are a source of unnecessary stress, and a business owner’s energy could be better spent on doing more essential tasks that grow the business.

78% of mid-sized businesses surveyed said they were more stressed about late customer payments this year compared to previous years. Worrying about late payments, cash flow, and how you’re going to pay your monthly business overheads is stressful. They can also cause anxiety and impact a business owner’s stress levels. Outstanding invoices don’t just impact cash flow and business growth. David Reid, Sales Director at VEM Tooling Further, the company weighed down by the sizable outstanding amount finds it hard to maintain smooth financial operations.” Due to the late payment issues, the GDP of an economy is mainly concerned. Late payments not only affect the businesses. This struggle further leads to the diminishing morale of the employees. “A business entity that is weighed down by the outstanding payments is more likely to face a downfall because of the fewer payment reviews, less payroll, and reduced productivity. How do outstanding invoices impact business owner stress levels? Late payments ultimately hold you back from completing more pressing tasks, but when customer invoices are paid on time, it enables you to focus your time and funds on growth. And 89% of these businesses said that late customer payments have set back their company’s long-term growth goals. Additionally, 81% of these businesses said that their customers had been late on their payments more often in 2021 compared to previous years.ħ6% of businesses said that their company must address its late payments before they could focus on growth. Mid-sized businesses said that, on average, they were owed $304,066 in late customer payments. Our survey also showed that businesses were owed a staggering amount in overdue payments. How much money are businesses owed in overdue payments?

#Email outstanding invoices in quickbooks how to#

Want to learn more about streamlining and managing B2B payments? Check out our article: How to manage and accept B2B payments: A guide for small businesses.

#Email outstanding invoices in quickbooks software#

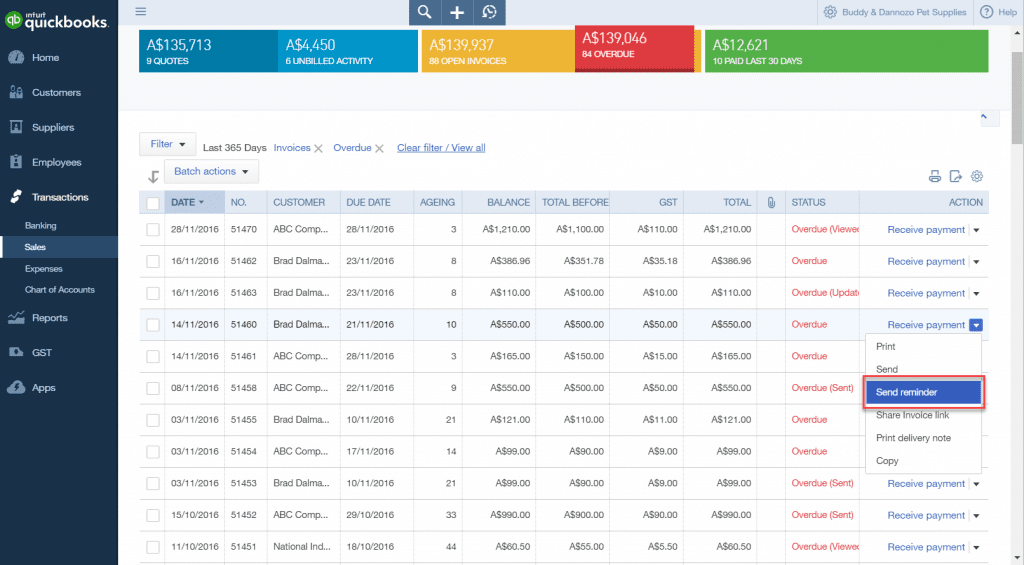

Additionally, using the wrong software for your business can lead to delays and cash flow issues.

This disorganization can cause problems for businesses trying to manage and minimize late customer payments. 50% of mid-sized businesses said that they either had multiple digital platforms with some automation across these platforms or individual digital processes with no automation within each process. The lack of effective technology and efficient processes could also be seen in payment system automation. In fact, 41% of businesses said they were worried or overwhelmed about their company’s payment process technology. When faced with any business problem, it can be hard to know where to start or know what solution is right for your business. On top of the challenges and delays in collecting payments, 81% of businesses said that they didn’t have a fully integrated payment system, and 76% said that the economic impact of COVID-19 accelerated their need for more efficient payment processing solutions. But it’s not just late payments that were causing issues for businesses.

0 kommentar(er)

0 kommentar(er)